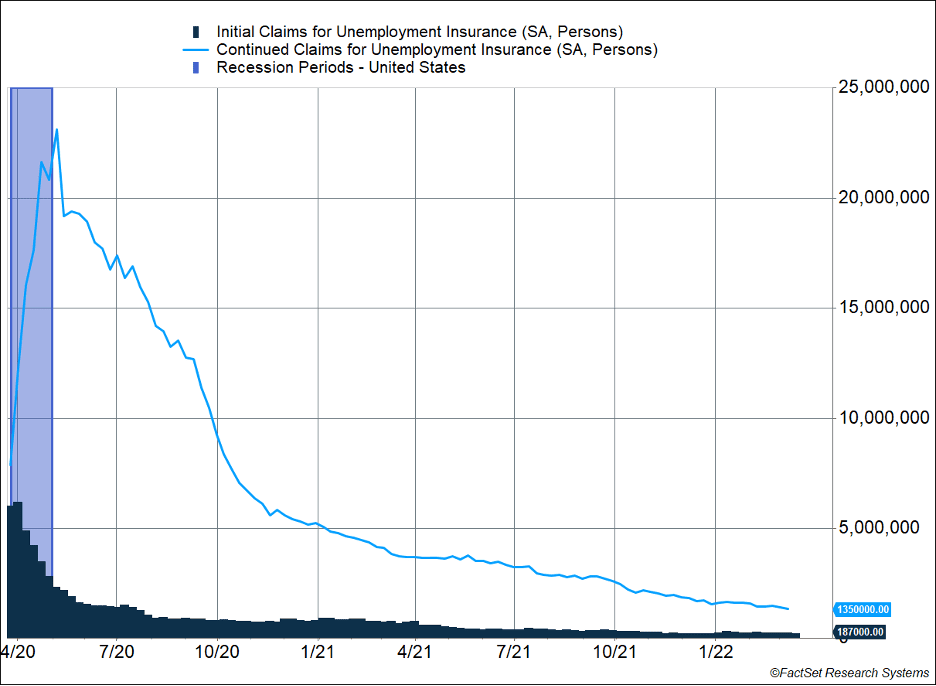

Initial jobless claims reached their lowest level since September 1969. Continuing claims fell to 1.35 million and reached their lowest level since 1970. The labor force was half as large then as it is today. Concerns about inflation, excess demand, and uncertainty about Russia’s attack on Ukraine have not stopped firms from keeping the workers they have on the payroll (Figure 1).

Key Points for the Week

- Initial jobless claims fell to 187,000 from 215,000 the prior week. That is the lowest level since 1969.

- Federal Reserve officials used speeches and interviews to suggest the odds of a half-a-percent increase was possible in the next meeting.

- Chinese economic data indicated industrial production rose 7.5% and retail sales increased 6.7%. Both beat expectations by a wide margin.

A bevy of Federal Reserve officials commented last week that a half-a-percent increase in interest rates could be appropriate. The number of speakers commenting about accelerating rate increases spurred expectations higher. The two-year yield increased 0.33% and the 10-year yield jumped 0.32%. Market expectations for a half-percent increase at the May meeting moved from 44% to 73%.

The S&P 500 continues to rally from recent lows. The index of large-cap stocks added 1.8% last week. The MSCI ACWI added 1.2%. The Bloomberg U.S. Aggregate Bond Index fell 0.8% as the more aggressive Fed policy pressured bonds. Key inflation and jobs data lead the data releases this week.

Figure 1

Clarifying Comments

The Federal Reserve had a lot to communicate two weeks ago when it increased the number of planned interest rate hikes and reassessed expected growth rates for the economy. This Fed has generally done very well at communicating its intentions via written signals and press conferences. Fed officials often use speeches and media appearances to reinforce key points made in the press conferences.

Last week was an exception. Rather than reinforcing all the key points, Fed officials signaled a greater openness to increasing the pace of interest rate hikes as the Fed seeks to unwind economic support provided during the early stages of COVID-19.

Fed Chair Jerome Powell spoke last week at the National Association for Business Economics and had a decidedly more hawkish tone than the previous week at the wrap-up of the Fed meeting. In the speech he mentioned the Fed is willing and able to raise rates a full 50 basis points (a basis point is 1/100 of a percent) at one or more meetings this year to fight off inflation.

Prior to the meeting, the Fed’s expectation was for 25bp hikes at each meeting for the rest of the year, reaching a federal funds rate of 1.9% at the end of the year. With this more hawkish tone, the market is now pricing in a 73% likelihood of at least two 50bp hikes this year, with a year-end federal funds rate of 2.38%.

Powell cited several issues that have changed the Fed’s outlook. First, the prospect of inflation returning to normal levels once the supply-chain bottlenecks correct themselves has deteriorated, mainly due to the conflict in Ukraine. If anything, the energy and commodity impacts this year have made some of those bottlenecks worse. He also indicated we may have seen the end of the push toward globalism, one of the forces that has helped to keep inflation in check. A more fragmented global economy could lead to higher overall inflation moving forward, regardless of Fed action.

When the Fed wants to signal a new course, rarely does it do so with just one person. Other Fed officials shared the same message last week. Federal Reserve Bank of Cleveland President Loretta Mester said, “I think we’re going to need to do some 50-basis-point moves.” She also believes the economy can withstand a more rapid increase in rates to tame inflation while not pushing the economy into recession. John Williams, who serves the same role in the Federal Bank of New York, stated he was open to raising rates 50 bps if appropriate.

Bond yields adjusted to reflect the possibility of a faster increase in interest rates. Rates on two-year Treasury notes broke through the 2% level last week. Investors showed concern that the Fed may become overly restrictive and push the economy into recession. The yield on the 10-year Treasury is now below the yield for recently issued bonds maturing in three, five, or seven years. When yields are higher for a shorter-term bond than one with a longer maturity it means the market is anticipating the Federal Reserve will raise rates too high and have to cut them later.

These comments do not guarantee a more rapid rate of increase, but data is pointing in that direction. The multi-decade low in the initial unemployment claims contributed to the increased odds of a 50-basis-point hike. The employment data indicate very few workers are getting laid off and labor markets remain tight. This week’s update on the U.S. employment situation will provide further information that will shape the Fed’s intentions. If the jobs situation continues to remain robust, our expectation is the Fed will raise rates 50 basis points at its next meeting.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

Compliance Case #01317084