There are countless ways to give—from dropping off your old couch at local donation center to volunteering at the local soup kitchen. When it comes to monetary gifts, it’s worth thinking through how to give in a way that both supports your values and helps maximize...

WHO DO WE SERVE?

Multigenerational Families

You have a complex situation that should consider multiple generations. Distributing and sharing wealth, building a family enterprise, and enjoying life while you do it requires intentionality. Most of us lead busy lives and don’t necessarily have an opportunity for reflection on how our deeply held values and beliefs have influenced both our accumulation of wealth and our priorities for its use.

Everyone seen, heard, prioritized.

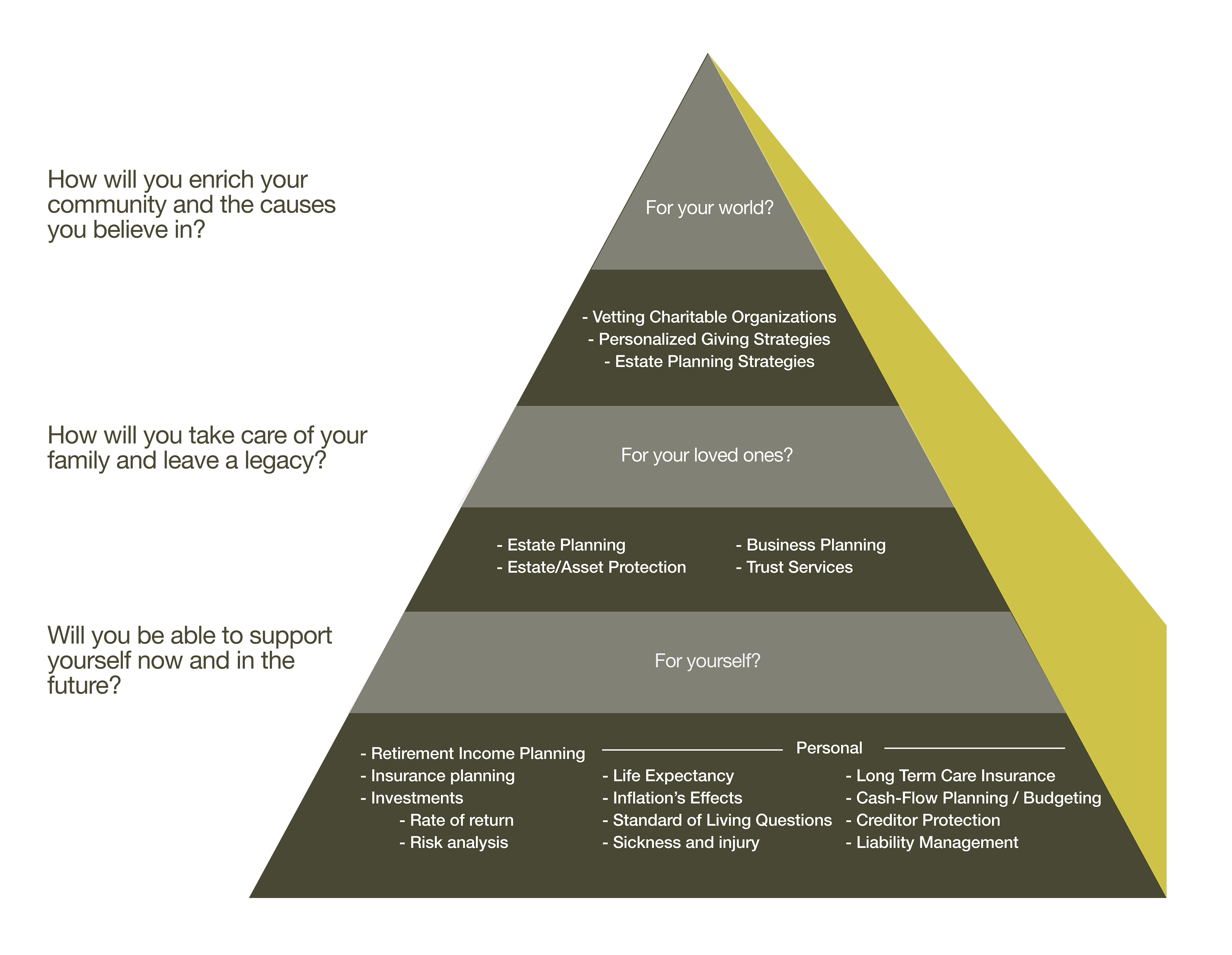

As a multi-family office, our mission is two-fold: (1) Empower each generation to fulfill their role in furthering the purpose of the family’s wealth, and (2) Engage each member of the family to discover their unique ability to enrich their world.

Depending on where you are in life’s journey, our services could involve quantifying your wealth, hosting family meetings, and considering gifting strategies to family or charity. We want your core values to be the anchor to key decisions and during life milestones. Through our private client services, we can help you and your loved ones every step of the way.

Questions we ask the families we serve:

- What behaviors and beliefs have supported your success and how have they allowed you to continue to maintain and grow your wealth?

- What has your wealth allowed you to do during your lifetime and why that was important to you and your family?

- What has been the role of philanthropy in your family? Why?

- What are the threats to your family’s financial well-being? Do you foresee any obstacles to achieving your goals?

Planning for Generosity

Our goal is to work closely with families to understand their service goals and interests. For some, planning for generosity means ensuring their children’s future aspirations can be supported. For others, planning for generosity means strategically gifting throughout their life or accumulating wealth to make a lump sum donation or gift to a nonprofit. Others serve with their time and talent.

We aim to put all the ways of planning for generosity on the table to make sure you know all your options to better the world.

Recent Posts

How Estate and Gift Taxes Can Impact Your Financial Plan

Tom Fridrich, JD, CLU, ChFC®, Manager and Senior Wealth Planner Giving something you own to someone else. It’s a simple, human act – one that seems like it shouldn’t take too much planning to do it correctly. But when does gifting become a tax issue? What do you need...

Why You Might Need a Power of Attorney

No one wants to think about a day when they can no longer conduct their own affairs. But you’ve probably heard stories about people experiencing unexpected health issues that temporarily, or permanently, keep them from exercising their independence. In these...

Next Generation Focus

Being a part of this “next generation” is a daunting task. Maybe you’re stewarding a legacy of great business success, or perhaps it’s one of extraordinary generosity. You could be transitioning from your first business sale to your next entrepreneurial pursuit. Whatever the opportunity in front of you, you are a part of a generation that is not only the most technologically savvy but also the most educated. As a result, making informed decisions is integral to your continued success.

We’ll meet you where you’re at

As a part of your trusted team, your life’s vision becomes our priority. We take on a collaborative, team-centered approach to managing and building wealth. We leverage our knowledge with technology, bringing innovative tools and new trends into each individual plan and offering professional services that meet your personal and business needs. Our team is well equipped to work through any unique planning situations that may arise as you grow.