Planning for Generosity

What Does Giving Mean to You?

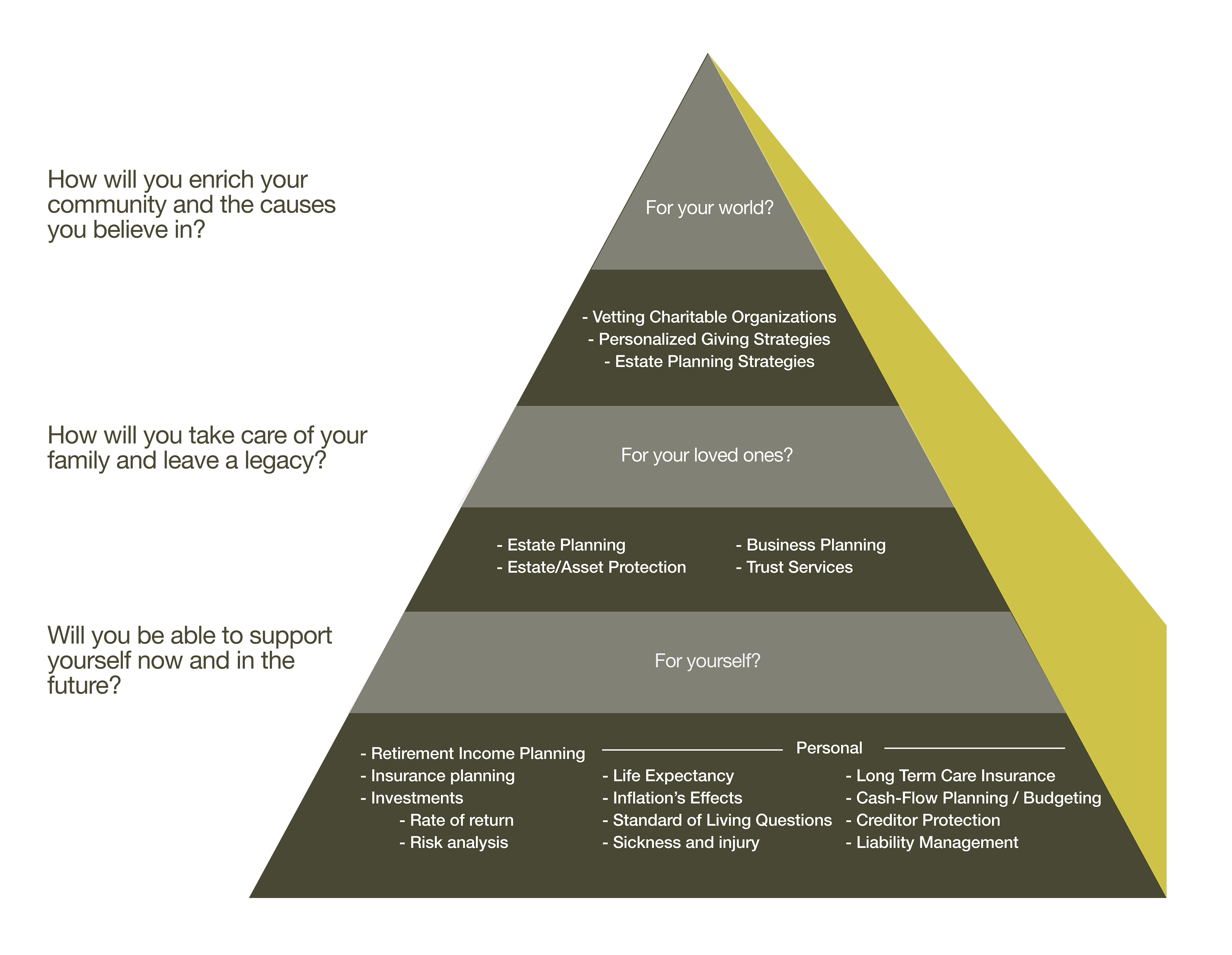

Our goal is to work closely with the families we serve to understand their service goals and interests. For some, planning for generosity means ensuring their children’s future aspirations can be supported. For others, planning for generosity means strategically gifting throughout their life or accumulating wealth to make a lump sum donation or gift to a nonprofit. Others serve with their time and talent.

We aim to put all the ways of planning for generosity on the table to make sure you know all your options to better the world.

Do You Know the Benefits?

HERE ARE A FEW OF OUR STRATEGIES

Donor Advised Fund

This is a simple strategy to establish your own family charitable account to benefit causes important to you. It also may facilitate bunching of contributions and donation of appreciated stock to minimize capital gains taxes.

Qualified Charitable Distributions

A strategy for sending Required Minimum Distributions (RMD) directly to a qualified charity that may decrease your income taxes while supporting a cause that’s important to you.

Charitable Remainder Trust

This strategy leaves the principal to your favorite charities while providing a tax efficient vehicle to provide income to you or your heir. It can also defer income and taxes for an IRA beneficiary while allowing for charitable deductions, reducing capital gains taxes, providing an income stream and many other benefits.

Private Foundation

This strategy establishes a charitable legacy for your family, provides tax benefits, and allows you to consider your family’s impact on the world.

Socially Responsible Investing

These investment strategies incorporate ESG (Environmental, Social, and Governance) data and can be designed specifically to match your niche values.

Why We Think it’s Worthwhile

Children’s Generosity

Children hear what we say but they watch what we do. This can mean involving your children in current financial decisions and engaging in volunteerism to inspire an intergenerational transmission of generosity. In order to pass on wisdom before passing on wealth.

Taxes

Giving to social causes is a requirement in our society. The question is whether you want to be a voluntary or involuntary philanthropist. In many strategies, dollars you give replace dollars you otherwise pay in taxes.

Retirement Satisfaction

Retirees are less likely to experience depression when they volunteer 200 hours of their time to service per year.

Overall Money Management

Taking the time to budget for recurring donations, even as you grow your wealth, makes giving a habit and can also promote thoughtfulness and intentionality with your everyday expenses.

Impact Potential Today

From your chosen cause to your own well being, service and giving have proven to increase happiness, health and even longevity. Investing sustainably has the potential to reap what are known as “total returns” – when an investment betters both your portfolio and the world.

Legacy

People tend to be more generous to those they perceive as generous. We hope that our firm and the families we work with can intentionally establish a reputation of global and local service.

Does Your Plan Maximize Your Benefits? Let Us….

Learn from You

Tell us what you care about and your current strategies. We build some of our most creative and inspiring strategies from conversations with our clients.

Take a Look

Do you wonder if there’s a more efficient way to sustain your impact? Let us take a look at your current plan to see if you could have even more of an impact on the causes and passions you love. Our team of experienced professionals will research and create opportunities to maximize your impact.

Come Alongside You

We want to do more than just plan for your giving. Talk to us about your nonprofit’s upcoming fundraiser or event. How can we serve with you and support your cause?

Where it Started for Us

In 2006, the Quigley family started doing international service trips – the first to Guatemala to build a playground.

Six years later, we worked together to start our nonprofit, Hope’s In, which works locally in Chicago and internationally in the Guatemala City garbage dump communities.

Today, Barrington Wealth Management is growing to work with as many clients’ causes as possible. But our hearts are still with our own. We make monthly contributions to Hope’s In’s development and programs, serve on its board and bring families down – sometimes clients – to Guatemala City every year.

We are particularly excited about Hope’s In’s new programs directed toward young moms and the community of people with disabilities as well as the growth of Oso – a teddy bear company that employs twelve women at double the community’s average income.

We love to give back to our community. Click the button below to read more!

How Can We Serve With You And Support Your Cause?

We want to do more than just plan for your giving.

Talk to us about your nonprofit’s upcoming fundraiser or event. How can we serve with you and support your cause?